Home » Markets we serve » Insurance & Finance

Outsourcing of Customer Service to Insurance and Financial Companies

Build lasting relationships.

Digital transformation is leading the insurance and financial services industries into a new customer-centric era.

In order to thrive, you need new ways to provide meaningful value to your members and customers. With today’s complex interactions, your contact center has become the center of connection.

Savi is an expert at elevating the critical point of human connection.

We help your customers get answers in the channel of their choice, including the all-important voice on the phone.

We partner with customer-centric insurance and financial services firms like yours to help you deliver on your promises to members and customers and build lasting connections.

The Savi way.

Knowledge & Professionalism

Channel of choice + humans.

Today’s customers expect ease of service in the channel of their choice. They want answers about their member service benefits, eligibility and enrollment, and billing.

Savi delivers an omnichannel experience that enables you to connect with members and customers when, where, and how they want – boosting customer satisfaction.

And when customers need help deciphering complex information to understand services and benefits, our Agents connect on a personal level. At Savi, we make complexity simple for you and your customers.

Deliver on your promises.

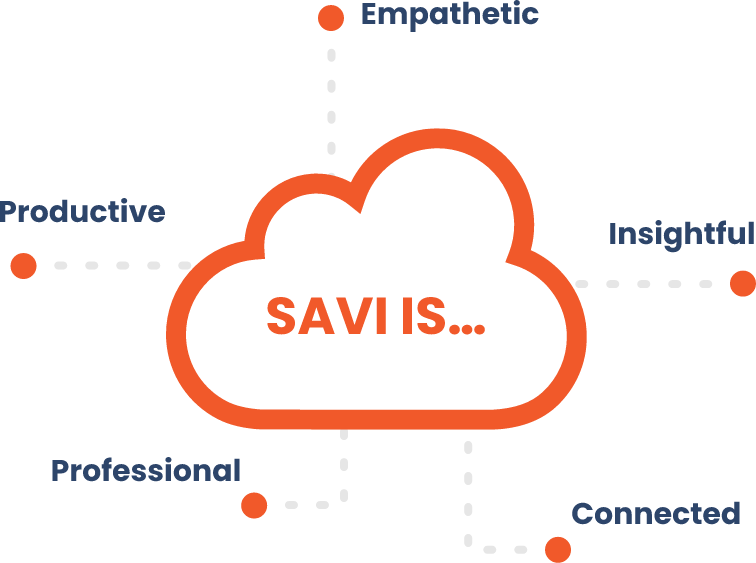

Savi delivers the critical elements needed to connect your company with your customers and members and elevate their experience with your brand:

- Savi is productive. Well-designed processes enable customer service agents to quickly decipher what the customer needs and get answers.

- Savi has deep insights. A complete understanding of your program helps us develop resources that enable Agents to explain complex concepts and services in a way that makes sense to members and customers.

- Savi is empathetic. Our Agents find meaning in helping your customers and thrive on easing frustration in confusing situations. We create positive customer experiences.

- Savi is professional. A team that ensures the utmost care of customers’ personal and confidential data builds trust in your company.

- Savi runs on omnichannel. Savi Agents can meet your customers where they want to connect. Human and virtual chats, email and web forms, and direct personal contact are all designed to improve the customer experience.

Customer-centric in digital age.

Build lasting relationships.

Gain the benefits of digital transformation at Savi to strengthen the human connection with your customers. Savi is a high-performing, responsive and flexible partner. We help insurance and financial services firms adapt to changing market dynamics with new solutions and processes to improve operational performance while elevating the customer experience. With unprecedented and evolving market needs, we understand that flexibility and responsiveness to staffing, training, delivery are more important than ever to you.

We diligently anticipate, listen actively, and collaborate closely with our partners to optimize impact and outcomes.

Transform your contact center

Is your contact center transaction-centric or relationship-centric?

You’re not imagining it: your contact center interactions have become more complex.

Learn the reasons driving this change, and how to position your business to create a more effective customer connection.

- Omnichannel technology’s role

- AI and self-service impact

- How to refocus on customer-centricity

- Evaluate your contact center with a self-assessment tool

Insurance & Finance FAQ

Question #1: What are the benefits of outsourcing customer service in the insurance and financial sector?

Outsourcing customer service in the insurance and financial sectors to specialized BPO firms presents numerous advantages, from enhancing customer experiences to boosting cost efficiency. Key benefits include:

- The provision of omnichannel support.

- Allowing customers to engage through their preferred methods.

- Thus elevating their overall experience.

It also brings significant cost reductions as these outsourced services eliminate the need for extensive internal infrastructure. Access to specialized expertise ensures that customer inquiries are addressed precisely and professionally. Companies can then concentrate on their primary functions, product development, while outsourcing handles customer interactions. The flexibility and scalability BPOs offer are vital for managing varying demands and ensuring consistent service quality. These firms possess deep knowledge of industry regulations, aiding in compliance and risk management. They utilize cutting-edge technology, providing advanced solutions without hefty investments from the insurance or financial company. Quality monitoring ensures continuous service improvement, and strict adherence to data security and privacy laws protects sensitive information. Outsourcing introduces innovative service strategies, incorporating technologies like AI chatbots and advanced CRM systems, further enhancing customer service and operational efficiency in the insurance and financial sectors.

Question #2: How does outsourcing customer service impact the quality of service in insurance and finance companies?

Outsourcing customer service in the insurance and financial sectors can significantly enhance service quality through access to specialized expertise and advanced technologies. Insurance and finance BPOs employ professionals with deep knowledge of industry specifics, improving response accuracy and customer satisfaction. Implementing omnichannel solutions ensures seamless interactions across various platforms, elevating the customer experience. Outsourced centers maintain stringent quality control and consistency in service, with established metrics to meet high standards. They offer scalability, enabling companies to manage peak periods efficiently without compromising service quality. These centers utilize cutting-edge technology, improving service efficiency and effectiveness. Continuous staff training in these BPOs enhances service proficiency. However, potential communication challenges may arise, especially with offshore services, which could impact interaction quality. Outsourcing streamlines service processes, leading to quicker and more effective issue resolutions. Adherence to data security and compliance is stringent, maintaining customer trust. Additionally, cost savings from outsourcing allow companies to invest in product and service enhancements, indirectly benefiting the customer experience. Outsourcing in these sectors can substantially improve service quality, provided communication and company alignment are meticulously managed.

Question #3: What factors should be considered when selecting an outsourcing partner for customer service?

When choosing an outsourcing partner for customer service, especially in specialized sectors like insurance and healthcare, it’s essential to consider various factors to ensure alignment with your company’s needs and quality standards. Evaluate the partner’s industry-specific expertise and experience to ensure they have the necessary knowledge and skills. The quality of their omnichannel solutions is critical for seamless customer interactions across different platforms. Assess their market reputation and track record for reliability and service excellence. Compliance with industry-specific regulations and data security standards is non-negotiable, given the sensitivity of information in these sectors. Technological prowess, including advanced CRM and data analytics capabilities, is vital for effective service management. Cost considerations should be balanced against the quality of services provided. The partner’s ability to scale services in response to your business’s changing demands is crucial. Language and cultural compatibility are essential for effective customer communication. The outsourcing firm’s customer service philosophy should align with your company’s values and commitment to customer satisfaction. Investigate their training programs to ensure ongoing staff development and adherence to industry standards. Contractual flexibility is essential to adapt to evolving business or market needs. Lastly, the partner should have mechanisms to capture customer feedback and commit to continuous service improvement. Careful consideration of these factors will aid in selecting a partner that can deliver high-quality, compliant, and effective customer service.

Question #4: How do outsourced customer service solutions integrate with existing systems in finance and insurance?

Integrating outsourced customer service solutions within the finance and insurance sectors involves meticulous coordination to ensure seamless functionality and data cohesion. This process starts with a compatibility assessment, where the BPO firm evaluates the existing systems to ensure the new solutions will integrate without hitches. Key steps include harmonizing omnichannel platforms with current systems, providing data migration is secure and synchronized, and customizing services to fit the specific operational workflows of the company. Rigorous testing is crucial to confirm system robustness, complemented by comprehensive training for the BPO staff on the client’s systems and processes. Continuous monitoring is essential for maintaining system efficiency, alongside stringent security and compliance measures to protect data integrity and adhere to industry regulations. The system’s scalability is vital for adapting to business growth or changes, with ongoing technological support to ensure the system remains up-to-date and effective. Through these strategic steps, finance and insurance companies can leverage outsourced solutions to enhance customer service while ensuring alignment with their existing operational infrastructure.

Question #5: What are the cost implications of outsourcing customer service for insurance and financial companies?

Outsourcing customer service in the insurance and financial sectors can lead to varied cost implications, primarily perceived as a strategy for cost reduction. Key considerations include the significant decrease in operational expenses as firms save on infrastructure, technology, and personnel costs by leveraging the resources of outsourcing partners. These partners offer access to advanced technologies and omnichannel solutions without the hefty initial investment. Their variable cost model allows for financial flexibility, adapting to fluctuating demand. Costs associated with training and recruitment are transferred to the BPO firm, potentially yielding more efficient service at a lower price. Outsourced centers might deliver higher efficiency and productivity, potentially enhancing customer satisfaction. However, maintaining service quality and compliance might incur additional monitoring costs. Initial investments may be required to integrate outsourced services with existing systems. It’s crucial to be mindful of potential hidden costs in contracts. While initial setup costs exist, the long-term benefits often include operational efficiency and the ability to focus on core activities, improving customer retention and loyalty, which are financially advantageous in the long run. Hence, while outsourcing offers cost-saving prospects, a comprehensive analysis considering all potential costs and benefits is essential for making an informed decision.